The Breach: Calculating the Human Cost of the Terrible Tax Bill

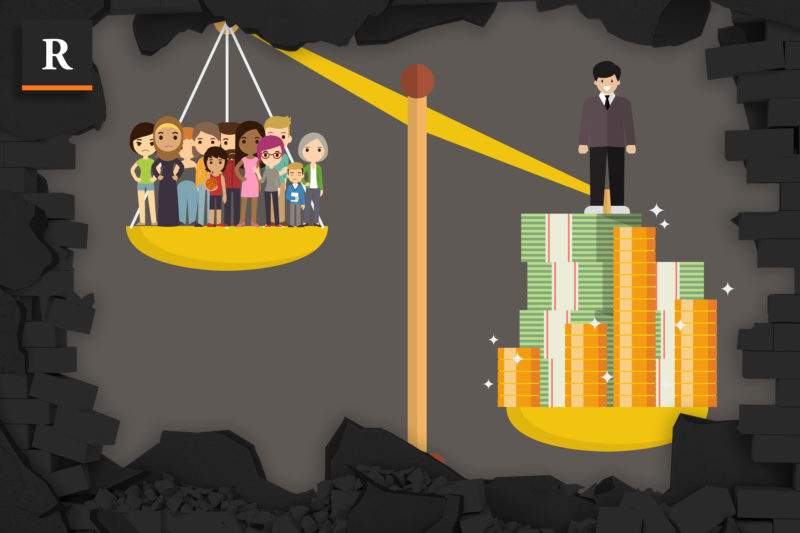

Chye-Ching Huang of the Center on Budget and Policy Priorities joins host Lindsay Beyerstein to break down exactly how the Senate tax bill will shift massive amounts of wealth from working people to corporations and the rich.

Chye-Ching Huang of the Center on Budget and Policy Priorities joins host Lindsay Beyerstein to break down exactly how the Senate tax bill will shift massive amounts of wealth from working people to corporations and the rich.

An edited excerpt:

Lindsay: People have talked about the impact of this bill, if it ultimately becomes law, as changing our whole way of life. What kind of programs and government activities and just the stature of the U.S. in the world, what kind of decline are we looking at if we’re losing these trillions of dollars?

Chye-Ching: I think that’s a really great question, to be looking forward to how does this affect fundamentally revenues, and the budget, and the way that programs are funded. I think we want to take really seriously what congressional Republican leaders have been saying, both in their budgets and recently, which is that these tax cuts for the wealthy are just the prelude to cutting vital programs. That could have really important impacts for families and the economy. In their budgets, in fact in the budget resolution that set off this entire process with this tax bill, they set out clear goals of deeply cutting Medicaid, Medicare, and other health programs, and they set up goals of cutting the part of the budget that funds education and training, transportation and infrastructure, medical research, child care, elder care—lots and lots of things that are really important to strengthening communities and the economy as a whole.

Recommended Reading:

Does the GOP Tax Plan Include a Tax Cut for Private Jet Owners? by Alex Kasprak for Snopes, November 2017