‘Fundamentally Unfair’ Tax Systems Toughest on Low-Wage Workers, Women

A recent report finds that the poorest 20 percent of Americans effectively pay twice as much of their income in taxes as the richest 20 percent.

Being poor is expensive. People who live paycheck to paycheck and have no savings end up paying more for basics like food, housing, and transportation, and then they pay more to borrow money in order to cover those expenses.

Despite conservative economic rhetoric to the contrary, taxes are yet another way that poorer Americans—who are disproportionately women—have to pay more because they earn less.

A report from the nonpartisan Institute on Taxation and Economic Policy (ITEP) finds that the poorest 20 percent of Americans effectively pay twice as much of their income in taxes as the richest 20 percent.

The nationwide average of all state and local income, property, sales, and excise taxes is 10.9 percent for the poorest 20 percent of Americans, 9.4 percent for the middle 20 percent, and just 5.4 percent for the top 1 percent.

Almost every state tax system is “fundamentally unfair” to people who make less money, the authors write, because people who earn less money have to pay a higher share of taxes.

It’s true that roughly 47 percent of Americans pay no federal income tax, but there are still state, local, and consumption taxes like sales tax. According to the report, it’s these taxes that add up to soak the poor and middle-class in almost every state.

This has a significant impact on women, who not only earn less than men but are also more concentrated in lower-paying industries and tax brackets.

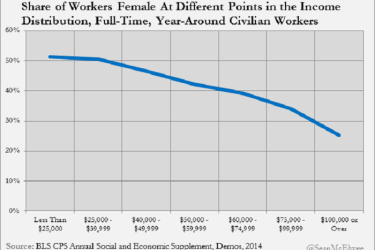

An analysis provided to Rewire by Demos research associate Sean McElwee finds that nationwide among full-time, year-round workers, women are more represented in lower tax brackets and less represented in higher brackets.

More than half of those who earn less than $25,000 are women, even though women only make up 43 percent of the full-time workforce.

Just a quarter of people who earn more than $100,000 are women.

The Institute for Women’s Policy Research has also broken down women’s representation in high versus low income brackets state by state.

Some states are more unfair than others, according to the ITEP report. The “Terrible 10” most regressive states tax their poorest residents at rates up to seven times higher than wealthy residents. Those states, from most regressive to least, are Washington, Florida, Texas, South Dakota, Illinois, Pennsylvania, Tennessee, Arizona, Kansas, and Indiana.

The reason some of these states tax their poor residents so unfairly has to do with the types of taxes they use, the authors said.

State income taxes are usually progressive (requiring higher-earning families to pay a higher percentage of their income), while property and consumption taxes are regressive (charging the poor a higher share than the rich).

Rick Perry may sing the praises of Texas for having no state income tax, but that comes at a price. Texas loses an important progressive tax policy, relies more heavily on regressive sales and excise taxes, and taxes its low-income residents at more than four times the rate of the rich.

Other top-10 most regressive states, like Illinois and Pennsylvania, do have a state income tax, but it’s a flat one that doesn’t give any extra benefit to lower wage earners.

And, the ITEP report authors note, even the least regressive states (California, Delaware, the District of Columbia, Minnesota, Montana, Oregon, and Vermont) “fail to meet what most people would consider minimal standards of tax fairness,” because at least some low- or middle-income groups still pay more than the wealthy.